When it comes to restaurant kitchen equipment, flexibility and automation have been on the minds of operators in recent years, mainly to curb staff shortages and optimize restaurant operations. And with these trends predicted to continue moving forward, equipment suppliers are having to re-examine how they do business.

“The trend towards automation with regard to foodservice equipment will continue and the feeling in the industry is that we’re just starting to see significant changes that every restaurateur can afford and apply to their organization,” says Andrew Rodricks, vice-president, Sales & Marketing at Newmarket, Ont.-based R.E.D. Canada. “Our company supports this automation and are looking to ensure that restaurant equipment dealers and end-user customers alike are educated in what the market has available, as well as what automation is on the horizon.”

But capturing the attention of end-users is difficult in an industry still facing daily post-pandemic challenges, says Danny Collis, principal, Collis Group Inc. “It’s very hard to get the attention of an operator. My colleague has family who own a restaurant. He spends his day looking for chicken, takeout containers and trying to keep staff, [not thinking of ways] to save money [on equipment]. We’re hoping now that the fall has hit that [operators] will start to look more closely at their operations.”

For example, Collis says his company’s oil-filtration pads can double a restaurant’s oil life and a number of large chains are starting to take notice. “That is huge when the price of oil has increased dramatically since COVID. Hopefully, operators will give us more of their time so we can prove we can save them money.”

Cash is King

As the restaurant industry moves into the new normal of doing business, cost savings are becoming even more important, which means on the equipment side, suppliers need offer products to help these operators do more with less.

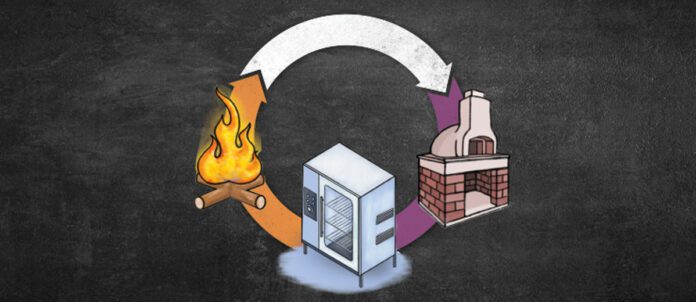

Rodricks says quite a few manufacturers have focused on multi-purpose equipment options. “In the past, this was limited to combi-ovens that had steam, convection and conventional cooking methods in one unit,” he explains. “These are still quite relevant in the market, however, quite a few variations have emerged out of this base.”

He points to units that are now able to apply various cooking methods to individual racks in the oven, without affecting the cook time or quality on anything else in the unit. “One of my favourite demonstrations was a chef who cooked a full tray of “Broiled Salmon” just one rack space above a pan of chocolate chip cookies — and when complete, there was absolutely no flavour transfer from one product to another. It was able to bake, broil, steam, braise, fry, et cetera inside a single unit that happens to come in full size, 2/3 size, half size, and/or even countertop configurations.”

He says these “all-in-one” machines are the type of automation that’s revolutionizing the market by offering operators options for innovative units that can now replace four to five pieces of equipment in a kitchen — without compromising the flavour or finish.

But how has the shift to off-premise dining during the pandemic impacted what equipment restaurants want in their kitchens? According to Collis, “I haven’t seen a fundamental change in equipment choices with off-site dining. Ghost kitchens, for example, still use traditional equipment and hopefully the equipment they have will work functionally for the tenant that goes in. Rapid-cook ovens have been very busy.”

Supply-Chain Woes

Supply-chain disruptions have impacted everyone’s lives and businesses and the foodservice-equipment sector have not been exempted, with the impact being felt by both international importers and domestic manufacturers. According to Rodricks, lead times have increased dramatically, as have costs in every facet of the business. Raw-material costs, transportation costs and labour costs have skyrocketed in the past couple years, forcing most brands to push three or four price increases inside of 12 to 18 months at levels that are unprecedented.

“The lead-time challenge is a result of both material/parts shortages for manufacturers, as well as transportation shortcomings,” says Rodricks. “Over the past few decades, most of the world’s manufacturing segment has moved towards a “just-in-time” methodology which (in theory) is a very economical model that can potentially reduce or eliminate holding costs up and down the supply chain. The problem with this model is that there is very little, if any, reserve stock available should anything happen along the supply line. We all felt this when store shelves ran out of toilet paper and everyone expected there to be warehouses full of inventory available — which there had been in the past but is obviously not so true anymore.”

He points specifically to challenges with deep fryers, refrigeration and standard cooktop items having lead times that stretched into months instead of weeks. “Recently it has turned a corner and manufacturers are catching up to demand with lead times starting to drop back into the higher end of regular range.”

But in the meantime, Collis says “the supply chain is still horrible. A lot of our smaller components come from parts of the world that have draconian COVID measures still and shut down on a second’s notice. One month we can ship 400,000 out the door then all of a sudden, we get stock and the next month is 1.3 million. One of our suppliers had 13 containers come into Houston. They could not get the product from Houston to Jackson as there were no drivers. To top it off they charged them extra storage for the containers sitting there.”

As a result, he says, manufacturers have had tremendous increases as they can’t absorb these fluctuations. “One factory explained to me that they have a double-digit increase and it takes a couple of months to see how those levels out. Well, they are still not making money so we will now see another increase. Some of our product here is for long-term care and hospitals and when we can’t get that it affects those people,” he says, adding “it’s been very hard to manage expectations and also cash flow in your own business — but we’re getting through it.”

Changing with the Times

With demand for automatic, wireless, and aesthetic designs in foodservice equipment that fit in smaller floor spaces growing, some equipment suppliers are seeing a shift in mindset when it comes to their customers’ purchasing decisions.

As the restaurant workforce gets younger, workers, managers, owner/operators, and designers have grown up with greater technology in their everyday lives. As a result, Rodricks says “it’s almost expected that certain pieces of equipment should be offered with these options. Likewise, there is a “less-is-more” minimalist mindset based on aesthetics, but also used for the practical reasoning of how expensive commercial real estate is with the subsequent cost per square foot playing a huge role in these choices,” he says. “It works to a distinct advantage for both restaurateurs needing equipment to be smaller, more efficient, multifunctional, et cetera, and manufacturers having the technology available to get equipment that can be run from a handheld smartphone from anywhere in the world.”

The industry is also seeing a renewed focus on energy-efficient, environmentally friendly equipment choices.

“In Canada, energy-0efficient equipment choices have been a focus for several years as the federal and provincial governments offer significant rebates on Energy Star rated units,” says Rodricks. “It is a win-win situation because the slightly higher upfront cost is offset a great deal (if not entirely) by the programs on offer.”

“I know there is such a large focus on the environment and sustainability and on a larger corporate level, this is addressed, but most people look for speed to turn out meals,” says Collis. “People still love gas. I have not seen a dramatic switch from that. At home I use induction and would never use gas because it’s great technology. [Equipment choices] will evolve a bit slower for restaurateurs and manufacturers, as this relies on heavy engineering and design — which is one thing our manufacturers no longer have.”

Up and Running

A recent study predicts North America is projected to be a prominent regional market for foodservice equipment, owing to high demand for replacement and renovations post pandemic. It’s a prediction Rodricks says his company is already seeing come to fruition.

“We’re absolutely seeing this in our business. Restaurant equipment in general tends to work better and stay in reasonably good shape if it is used on a regular basis. When you stop using it for any length of time, and then try to start it back up again — some pieces tend to break down. We can measure this by the influx of “rush” orders that came in immediately following the re-opening of restaurants after each shutdown. This is part of what prompted the supply-chain slowdown. Operators who were hit with the reality that the equipment they want may be subject to several months of waiting before product could be delivered reconsidered their wants vs needs.”

Instead, he says, many of them took this time to make renovations and make do with what they had so that they could order the equipment they wanted and do a renovation. “We have been seeing this for the past 18 months and expect the trend to continue well into 2023.”

“Our demand right now is quite large we are going to have a huge year,” says Collis. “Our colleagues in the U.S. have already seen the past few weeks slow down. There is a recession out there and there could be a huge pull back before we get really busy. So, I’m not as bullish moving forward into 2023.”

By Amy Bostock